Originally published in the Brandywine Asset Management Monthly Report.

Brandywine’s non-correlation is not a result of chance. It is by design. Based on Brandywine’s 30+ years of research and trading experience, Brandywine’s Symphony program incorporates dozens of fundamentally-based – yet systematically applied – trading strategies to trade across more than 100 global financial and commodity markets. Many of the trading strategies employed by Brandywine were developed more than two decades ago and their continued strong performance today proves they are based on logical “return drivers” that have withstood the test of time. (Visit brandywine.com to view a graphical illustration of Brandywine’s allocation across trading strategies and markets).

Diversification Examples

Perhaps the best way to explain the fundamental source of Brandywine’s non-correlation with “traditional” CTAs is to present some specific recent trade examples. In this section we’ll present three specific trades as examples that contributed to Brandywine’s differentiated performance.

The strategies that produced these trades, because they are based on “return drivers” that are distinct from trend following futures traders, also produced differentiated returns throughout the past year. These are three examples out of hundreds of potential examples of Brandywine’s unique trading model and performance. Exposing them is intended to provide you with a better understanding of Brandywine’s diversifying value when included in a portfolio of traditional CTAs.

Fundamentally-based Counter-Trend Strategy in Natural Gas

Although Brandywine is not a trend-follower, we do believe in the efficacy of trend-following. (Mike Dever discusses the value of trend following in chapter 7 of his bestselling book, Jackass Investing: Don’t do it. Profit from it. You can read a complimentary copy of that chapter here: http://bit.ly/wX2ONc). As a result, we have always been skeptical of buy-low, sell-high counter-trend strategies, UNLESS they are based on some sound fundamental principal (are not just a mathematical curve-fit). One fundamental concept that does make sense is using marginal cost-of-production concepts to trade low-priced commodities from the long side in a counter-trend fashion. A trading strategy based on this concept originated at Brandywine in the early 1990s and the strategy continues to perform positively today.

Earlier this year, due to rapid advances in natural gas extraction by energy companies as a result of the development of “fracking” and the exploration of “shale gas”, natural gas production in the United States reached new highs. As a result, natural gas prices reached multi-year lows. This triggered Brandywine’s fundamentally-based counter-trend strategy to begin buying natural gas as prices dropped well below $3 (MBtu). In a multi-strategy program such as Brandywine’s Symphony, this initially had the appearance of Brandywine “taking profits” on its short position.

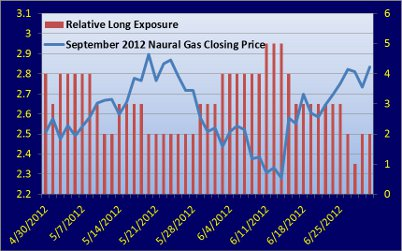

By the end of April however, Brandywine had established a net long position. As natural gas is just one of more than 100 markets traded in Brandywine’s Symphony program, the risk exposure of this trade to Brandywine’s portfolio was moderate, amounting to less than 20 basis points. Throughout May and June, Brandywine incrementally-traded this position several times. The chart below shows the long positions held by Brandywine over the past two months relative to the price of natural gas. The long position (right axis) is risk-based, such that a position of 4 had twice the long exposure as a position of 2. As is evident in the chart, as prices fell our long exposure increased and as prices rose Brandywine took profits on those long positions.

Brandywine’s Fundamentally-based Counter-trend Strategy in Natural Gas

(Long Exposure Relative to Natural Gas Price)

The end result was that during June this strategy produced a net gain of more than 30 basis points for Brandywine’s Symphony program, and it did so in a fashion that was completely uncorrelated to the returns of the other trading strategies employed by Brandywine. This strategy is also expected to be profitable on the majority (in excess of 70%) of its trades, while being selectively “in-the-market” less than 25% of the time. Historically, this strategy has a zero correlation to trend following CTAs.

Directional Arbitrage Trading in Currencies

A second group of strategies that contributed to Brandywine’s profits in June were “directional arbitrage” strategies employed by Brandywine in the currency and interest rate markets. These strategies look at forward curves and price differentials among currency and interest rate markets to establish directional trades based on biases in the data. As these strategies are based on return drivers that are unrelated to those that drive trend-following performance, the performance of these strategies is, on average, uncorrelated to that of trend-following CTAs. There are times, however, where performance can be highly negatively correlated. The last trading day of June was one example of this negative correlation. On that day trend-followers in the currency and interest rate markets suffered greatly as established trends in those markets reversed violently. Brandywine’s directional arbitrage strategies were well-positioned for this reversal and profited. This contributed to Brandywine’s +0.38% gain on June 29th. June 29th was not a one-day aberration however. Brandywine’s directional arbitrage strategies also contributed to Brandywine’s overall positive performance over the past 12 months.

Event Trading in the Dollar Index

Another unique category of strategies employed by Brandywine are event-based trading strategies. These were developed based on the discretionary trading experience of Brandywine’s founder in the 1980s. The return driver underlying these strategies is based on the fact that various events, such as the information contained in government reports, can trigger significant market moves or trend reversals in affected markets. Under certain conditions that short-term market reaction is predictive of future market direction. Brandywine’s event-based strategies are designed to capture those moves. One such trade, a short position in the U.S. dollar, was triggered following the release of the Employment Report on June 1st. Based on this event and subsequent market factors, Brandywine entered into a short position in the U.S dollar index. As this was an event-based trade, and not dependent on trends, this short position was entered into within days of the market top set on the morning of June 1st. Brandywine remained in this trade at the end of June. As a result of being in this trade, the collapse in the dollar on June 29th provided differentiated profits (compared with the major CTA indexes) for Brandywine’s investors.

Brandywine’s Event-based Trading in the Dollar index