Originally published in the Brandywine Asset Management Monthly Report.

In a recent television interview, the head of the asset management arm of one of the world’s largest private banks remarked that her number one concern was what the Fed would be doing. She is not alone; numerous other investment managers have expressed the significance of Fed decisions on the performance of their portfolios. Many believe the bond and stock markets are artificially priced (read “higher”) today as a result of the Fed’s actions or anticipated actions. Even Mohamed El-Erian, who rode the bond bull market to fortune and fame while at PIMCO, has stated that the majority of his money is now in cash, as he thinks most asset prices have been pushed by central banks to very elevated levels. He admits this means his portfolio value runs the risk of being diminished due to inflation, but prefers the inflation risk over the risk of having a Fed decision damage his portfolio.

Concern over Fed action (or inaction) is not the problem. It is merely the symptom of a much larger and pervasive problem. Because their portfolios are dominated by long stock and bond positions, these people have subrogated their investment responsibilities to a handful of people at the Fed (if not just one person!). Literally trillions of dollars of other people’s money is essentially out of their control. Not only is this ridiculous, but it is also unnecessary.

Long positions in stocks and bonds are only two potential ways to make money. In fact, to rely on portfolios dominated by long stock and bond positions is not investing at all. It is gambling (defined in this instance as a person taking unnecessary risks with their/your money), especially when the performance of those long stock and bond “poor-folios” is under the influence of a single decision maker, the Fed. But even without that dependency, it is a gamble to rely on the continued advance of stocks and bonds to produce positive returns. And it is unnecessary because there are so many additional opportunities available for people to truly diversify their portfolios.

“True” Portfolio Diversification

Portfolio diversification is the one “Free Lunch” of investing. It enables a portfolio to target both higher returns and less risk than a less-diversified portfolio. But while portfolio diversification is often preached, it is seldom practiced. That is because of the misguided focus on spreading money across long positions in “assets” or “asset classes.” By their very definition, asset classes are comprised of a group of securities that exhibit similar characteristics and perform similarly. So, very little diversification value can be obtained by spreading money across assets within each asset class. And if a “poor-folio” is constrained to only holding long positions in asset classes, and if those asset classes are subject to the same event risk (such as a Fed decision), then spreading money across asset classes provides little diversification value. Fortunately, there is an alternative.

Return Driver Based Investing

A Return Driver is the primary underlying condition the drives the price of a market. Today, both stock and bond markets are dominated by Fed action. That is the single dominant Return Driver. But rather than subject your portfolio to a single Return Driver, which results in singular event risk, you can diversify across numerous other Return Drivers. Not only will this diversify risk, but it will also create a portfolio that behaves independent of stocks and bonds. This is the approach taken by Brandywine. In addition to dramatically reducing the risk that an adverse Fed decision (or any single event) would have on the portfolio, this approach also results in performance that is completely uncorrelated to the performance of all other investment indexes, including stocks and bonds.

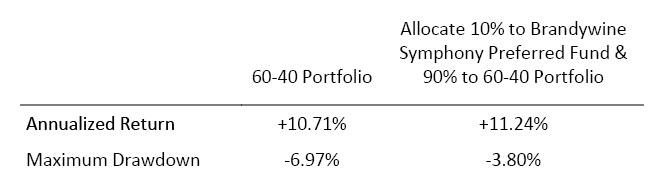

The results speak for themselves. Since the inception of Brandywine’s Symphony Program in 2011, the correlation of monthly returns between Brandywine and the S&P 500 has been just 0.19 and between Brandywine and bonds (measured by the Barclay Aggregate Bond Index) just 0.27. As a result, adding Brandywine to a “conventional” 60-40 portfolio both increases returns and reduces risk, as shown in the following table:

Bottom line: if you have a portfolio that is long stocks and/or bonds, or other Fed-dominated assets, and are concerned with how a drop in asset values will negatively affect your portfolio, adding an investment in Brandywine will create important diversification value.